Hey there, Kids Game! Ever think about what would happen if life threw you a curveball? Maybe a sudden illness, a car accident, or even a house fire? These unexpected events can not only be emotionally draining, but they can also wreck your finances. That’s where the importance of insurance comes in: it provides a safety net, a financial cushion to help you bounce back from life’s unexpected challenges. This article dives deep into why you need this financial protection and how it can safeguard your future.

Understanding the Basics: What is Insurance?

Insurance, at its core, is a contract between you and an insurance company. You pay regular premiums, and in return, the company agrees to cover specific financial losses you might experience due to unforeseen events. It’s essentially a risk-sharing pool where everyone contributes a small amount to protect each other from potentially devastating financial blows. Think of it like a financial umbrella, shielding you from the storms of life.

This system works because the insurance company collects premiums from many individuals, spreading the risk across a large group. This allows them to pay out claims to those who experience a covered loss without jeopardizing their overall financial stability. This concept of risk pooling is fundamental to how insurance works and why it’s so effective in providing financial protection. The importance of insurance: why you need financial protection becomes crystal clear when you understand this basic principle.

Different Types of Insurance and Their Benefits

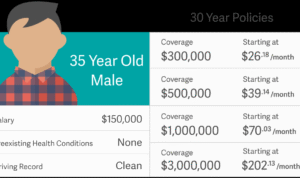

There are many types of insurance, each designed to protect you from different risks. Some of the most common include health insurance, car insurance, home insurance, and life insurance. Health insurance helps cover medical expenses, while car insurance protects you financially in case of an accident. Home insurance safeguards your home and belongings against damage or theft, and life insurance provides a payout to your beneficiaries upon your death.

Each type of insurance offers unique benefits tailored to specific needs. Choosing the right coverage depends on your individual circumstances and risk profile. It’s important to carefully consider your needs and research different policies to find the best fit for your situation. The importance of insurance: why you need financial protection shouldn’t be underestimated, especially when selecting appropriate coverage.

Protecting Your Health and Wealth: The Benefits of Insurance

Having insurance isn’t just about avoiding financial ruin; it’s about peace of mind. Knowing you have a safety net allows you to focus on what matters most, without constantly worrying about the “what ifs.” This peace of mind can have a positive impact on your overall well-being, reducing stress and improving your quality of life.

Moreover, insurance can also provide access to better healthcare, legal assistance, and financial advice, depending on the type of policy you have. This added support can be invaluable during challenging times, helping you navigate complex situations and make informed decisions.

Safeguarding Your Future: Long-Term Financial Security

Insurance is an essential tool for long-term financial planning. It helps protect your assets and ensures that your loved ones are taken care of in case of unforeseen circumstances. This is particularly important for those with dependents, as it can provide a financial safety net for their family in the event of their death or disability.

By investing in appropriate insurance coverage, you can secure your financial future and protect your loved ones from financial hardship. The importance of insurance: why you need financial protection cannot be overstated when considering the long-term implications.

Mitigating Risk: Shielding Yourself from Financial Loss

Life is full of unexpected events, and many of these can lead to significant financial losses. Insurance helps mitigate these risks by providing financial compensation in the event of a covered loss. This protection can be crucial in helping you recover from unexpected setbacks and maintain financial stability. The importance of insurance: why you need financial protection becomes even more apparent when you consider the potential financial devastation that can result from unforeseen events.

From natural disasters to accidents and illnesses, insurance can shield you from a wide range of financial risks, ensuring that you are not left to bear the full burden of unexpected expenses. This protection allows you to rebuild your life and move forward with greater confidence and security.

Planning for the Unexpected: Choosing the Right Insurance

Choosing the right insurance can seem daunting, but it doesn’t have to be. Start by assessing your needs and identifying the potential risks you face. Then, research different insurance providers and compare policies to find the best coverage at the most affordable price.

Don’t be afraid to ask questions and seek professional advice if needed. A qualified insurance advisor can help you understand your options and make informed decisions about your coverage.

Assessing Your Needs: Identifying Your Risk Profile

Understanding your risk profile is key to choosing the right insurance coverage. Consider factors such as your age, health, occupation, lifestyle, and family situation. These factors can influence your likelihood of experiencing certain events and help determine the type and amount of coverage you need.

For example, a young, healthy individual might prioritize health and car insurance, while someone with a family might prioritize life insurance and disability coverage. The importance of insurance: why you need financial protection is directly related to your individual risk profile and circumstances.

Budgeting for Insurance: Making it Affordable

Insurance is an investment in your financial security, but it doesn’t have to break the bank. There are many ways to make insurance more affordable, such as bundling policies, increasing your deductible, and shopping around for the best rates.

By carefully considering your needs and budget, you can find insurance coverage that provides adequate protection without straining your finances. The importance of insurance: why you need financial protection shouldn’t be a barrier to obtaining the coverage you need.

Comparing Insurance Options: A Detailed Breakdown

| Type of Insurance | Description | Average Monthly Cost (Estimate) | Key Benefits |

|---|---|---|---|

| Health Insurance | Covers medical expenses | $500 – $1500 | Access to healthcare, preventative care, protection against high medical bills |

| Car Insurance | Covers damages related to car accidents | $100 – $300 | Liability protection, collision coverage, comprehensive coverage |

| Home Insurance | Covers damages to your home and belongings | $50 – $150 | Protection against fire, theft, natural disasters |

| Life Insurance | Provides a death benefit to your beneficiaries | $25 – $100 | Financial security for your family, estate planning |

| Disability Insurance | Provides income replacement if you become disabled | $50 – $200 | Protection against loss of income, financial stability during disability |

Conclusion

The importance of insurance: why you need financial protection cannot be overstated. It provides a vital safety net, protecting you from financial hardship and providing peace of mind. By understanding the different types of insurance and choosing the right coverage for your needs, you can secure your financial future and protect yourself from life’s unexpected challenges. Kids Game, be sure to check out our other articles on financial planning and risk management for more valuable tips and insights!

FAQ about The Importance of Insurance: Why You Need Financial Protection

What is insurance?

Insurance is like a safety net. You pay a small amount regularly (a premium) to a company, and they promise to help you financially if something bad happens, like a car accident, house fire, or illness.

Why do I need insurance?

Unexpected events can be expensive. Insurance helps you pay for these costs, protecting you from financial hardship. It offers peace of mind knowing you’re covered.

What are the different types of insurance?

There are many types, but some common ones include health, car, home, and life insurance. Each one protects you from different risks.

How does insurance work?

When you buy insurance, you’re joining a pool of people who share similar risks. Everyone contributes premiums, and this money is used to pay claims when someone experiences a covered event.

How much does insurance cost?

The cost varies depending on the type of insurance, the level of coverage, and your individual risk factors. Getting quotes from different companies is a good way to compare prices.

How do I choose the right insurance?

Think about what you need protection for. Research different companies and policies, compare prices, and choose a policy that fits your budget and provides adequate coverage.

What is a deductible?

A deductible is the amount you have to pay out of pocket before your insurance coverage kicks in. Higher deductibles usually mean lower premiums.

What is a premium?

A premium is the regular payment you make to keep your insurance policy active. Think of it like a subscription fee for your financial protection.

What is a claim?

A claim is a formal request you make to your insurance company for payment after a covered event, like a car accident or house fire.

What happens if I don’t have insurance?

You’ll be responsible for paying all the costs yourself if something unexpected happens. This can lead to significant financial strain and debt. Having insurance protects your financial future.