Hey there, Kids Game! Ever feel like navigating the world of insurance is like trying to solve a Rubik’s cube blindfolded? We get it. Terms like premiums, deductibles, and coverage can be confusing. This article breaks down the key differences between life, health, and auto insurance in a relaxed, easy-to-understand way. We’ll walk you through each type, highlighting what they cover, why you need them, and how they work. Let’s dive in!

Section 1: Protecting Your Life: Decoding Life Insurance

What is Life Insurance?

Life insurance provides a financial safety net for your loved ones if you pass away. It’s a contract between you and an insurance company. You pay premiums, and in return, the insurer pays a death benefit to your designated beneficiaries. This money can help cover funeral expenses, mortgage payments, debts, and future living expenses for your family.

Types of Life Insurance: Term vs. Permanent

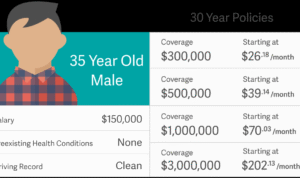

There are two main types of life insurance: term and permanent. Term life insurance covers you for a specific period (e.g., 10, 20, or 30 years). It’s generally more affordable than permanent life insurance. Permanent life insurance, on the other hand, provides lifelong coverage and often includes a cash value component that grows over time.

Why Do You Need Life Insurance?

Life insurance offers peace of mind, knowing that your family will be financially protected if the unexpected happens. It’s especially important if you have dependents who rely on your income. Even if you’re single, life insurance can help cover final expenses and outstanding debts.

Section 2: Safeguarding Your Health: Navigating Health Insurance

Understanding Health Insurance

Health insurance helps cover the costs of medical care, including doctor visits, hospital stays, prescriptions, and preventive care. It protects you from potentially crippling medical bills and ensures you have access to quality healthcare.

Different Types of Health Insurance Plans

Navigating the world of health insurance can be tricky. There are various plan types available, including HMOs, PPOs, EPOs, and POS plans. Each plan has its own network of doctors and hospitals, coverage levels, and out-of-pocket costs. Understanding these differences is crucial for choosing the right plan for your needs.

The Importance of Health Insurance

Having health insurance is essential for both your physical and financial well-being. It provides access to affordable healthcare, allowing you to seek treatment when you need it without worrying about the financial burden. Preventive care covered by health insurance can also help detect and manage health issues early, leading to better long-term health outcomes.

Health Insurance and Life, Health, and Auto Insurance: Understanding the Differences

Understanding the differences between life, health, and auto insurance is crucial for making informed decisions about your overall financial protection. While life insurance protects your loved ones financially after your death, health insurance safeguards your health and finances during your lifetime.

Section 3: Protecting Your Ride: The Basics of Auto Insurance

What is Auto Insurance?

Auto insurance covers financial losses related to car accidents. It protects you from liability if you cause an accident and helps pay for damages to your vehicle, regardless of who is at fault.

Different Types of Auto Insurance Coverage

Auto insurance policies typically include several types of coverage, such as liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Understanding these different coverages and their purpose is essential for choosing the right policy.

Why is Auto Insurance Important?

Auto insurance is not just a legal requirement in most states; it’s also a crucial financial safety net. It protects you from potentially devastating financial losses in the event of an accident. Life, health, and auto insurance: understanding the differences between these three types of coverage is key to a secure financial future.

Understanding the Importance of All Three

Life, health, and auto insurance each play a vital role in your overall financial well-being. They provide a safety net against unforeseen events, protecting you and your loved ones from financial hardship.

Section 4: Comparing Life, Health, and Auto Insurance

| Feature | Life Insurance | Health Insurance | Auto Insurance |

|---|---|---|---|

| Purpose | Protect loved ones financially after death | Cover medical expenses | Protect against financial losses from car accidents |

| Coverage | Death benefit | Medical treatments, hospital stays, prescriptions | Liability, collision, comprehensive, uninsured/underinsured motorist |

| Premiums | Based on age, health, coverage amount | Based on age, health, location, plan type | Based on driving history, car type, location |

| Benefits | Financial security for beneficiaries | Access to affordable healthcare | Protection against accident-related expenses |

| Necessity | Crucial for those with dependents | Essential for everyone | Legally required in most states |

Conclusion

We hope this breakdown of life, health, and auto insurance has helped clarify the differences between these essential types of coverage. Understanding these differences is the first step towards making informed decisions about your financial protection. For more in-depth information, check out our other articles on specific insurance topics. Remember, Kids Game, knowledge is power!

FAQ about Life, Health, and Auto Insurance: Understanding the Differences

What is Life Insurance?

Life insurance provides a financial payout to your beneficiaries (e.g., family) upon your death. It helps replace lost income and cover expenses like funeral costs, mortgage payments, and education.

What is Health Insurance?

Health insurance helps pay for medical expenses, such as doctor visits, hospital stays, prescriptions, and preventative care. It reduces your out-of-pocket costs for healthcare.

What is Auto Insurance?

Auto insurance covers financial losses related to car accidents. It can pay for damage to your car, medical bills for injuries, and legal expenses.

What’s the main difference between Life, Health, and Auto Insurance?

Life insurance protects your loved ones financially after your death, health insurance protects you from high medical costs, and auto insurance protects you from financial losses due to car accidents. Each covers a different type of risk.

Do I need all three types of insurance?

While not legally required in all cases (except auto in most states), having all three provides comprehensive financial protection for you and your family against different life events.

How much insurance do I need?

The amount of coverage you need depends on your individual circumstances. Factors like your income, family size, health status, and the value of your assets play a role. Consult with an insurance agent to determine the right coverage amounts.

How are insurance premiums determined?

Premiums are calculated based on your risk profile. Factors like age, health history (for life and health insurance), driving record (for auto insurance), and the amount of coverage you choose influence your premium cost.

What is a deductible?

A deductible is the amount you pay out-of-pocket before your insurance starts covering expenses. Higher deductibles usually mean lower premiums, but you’ll pay more upfront in case of a claim.

Can I change my insurance coverage?

Yes, you can usually adjust your coverage amounts and even switch insurance providers during open enrollment periods or under certain life events (e.g., marriage, birth of a child).

Where can I get more information about choosing the right insurance?

You can consult with an independent insurance agent, financial advisor, or compare policies online through various insurance comparison websites. It’s important to research and understand your options before making a decision.