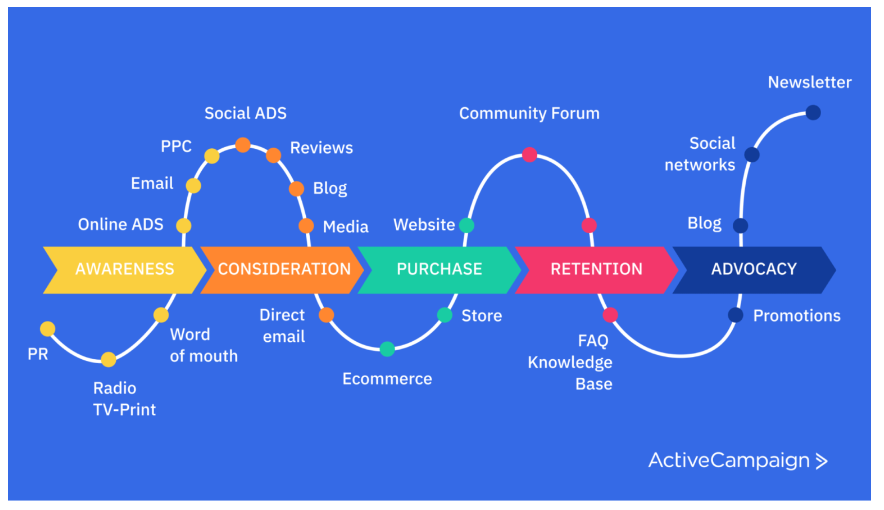

How to Manage Multiple Marketing Channels with Ease sets the stage for a discussion on the dynamic landscape of marketing in today’s digital age. Balancing various channels—be it social media, email, or content marketing—can be a challenge, but with the right strategies and tools, it becomes a manageable endeavor. Understanding the unique strengths of each channel and how to integrate them effectively into a cohesive marketing strategy is essential for success.

This exploration dives into practical techniques for organizing your marketing efforts, optimizing resources, and ensuring consistent messaging across platforms, allowing businesses to reach their target audiences more efficiently and effectively.

In today’s fast-paced world, the demand for convenience and efficiency drives many of our daily choices. Whether it’s the way we shop, communicate, or even manage our finances, technology plays a crucial role in shaping our experiences. One of the most significant advancements in recent years is the rise of digital banking, which has transformed the traditional banking landscape into a more accessible and user-friendly environment.Digital banking refers to the use of digital technology to deliver banking services to consumers.

This includes everything from online banking websites to mobile banking applications. The primary aim is to provide customers with the ability to conduct transactions and manage their finances without needing to visit a physical bank branch. This concept has gained immense popularity due to its numerous benefits, including time savings, cost efficiency, and enhanced accessibility.### The Evolution of BankingTo understand the significance of digital banking, it is essential to look back at the evolution of banking itself.

Traditional banks have been around for centuries, serving as a reliable place for people to store their money and access financial services. However, the logistics of brick-and-mortar operations often meant longer wait times, limited hours, and geographical constraints.The introduction of the internet in the late 20th century brought about a seismic shift in how consumers interacted with their banks. Initially, banks began to establish online banking platforms that allowed customers to check their account balances and make transfers from the comfort of their homes.

As technology continued to advance, so too did the functionality of these online platforms.With the advent of smartphones, mobile banking emerged as a game-changer. Now, consumers could perform banking tasks on-the-go, utilizing applications that provided real-time access to their finances. This shift to digital banking has not only improved convenience but has also revolutionized the way banks operate, enabling them to streamline processes and reduce operational costs.### Advantages of Digital Banking

1. Convenience

Digital banking provides unparalleled convenience. Customers can access their accounts 24/7, allowing them to manage their finances whenever and wherever they choose. Whether it’s checking balances, transferring funds, or paying bills, everything can be done with just a few taps on a mobile device.

2. Cost-Effectiveness

Many digital banking services are free or come with lower fees compared to traditional banks. This is largely due to reduced operational costs for banks that do not need to maintain physical branches. Consumers can save money on fees while also benefiting from higher interest rates on savings accounts, as digital banks often have lower overhead costs.

3. Enhanced Security

Despite initial concerns about online security, digital banking has implemented advanced security measures to protect consumer information. Encryption, two-factor authentication, and biometric security features, such as fingerprint scanning, have become standard practices. Moreover, digital banks often monitor accounts for unusual activity and provide instant notifications for any transactions made.

4. User-Friendly Interfaces

The digital banking experience is designed with user experience in mind. Most banking apps and websites offer intuitive interfaces that simplify navigation and make it easy for users to find the services they need. This focus on usability is particularly beneficial for tech-savvy younger generations who expect seamless digital experiences.

5. Access to Financial Tools

Digital banking platforms often come equipped with a variety of financial management tools that can help users analyze their spending habits, set budgets, and track savings goals. These features empower consumers to take control of their finances and make informed decisions.### Challenges of Digital BankingWhile digital banking offers numerous advantages, it also poses some challenges that consumers and banks alike must address.

1. Digital Divide

Not everyone has equal access to the internet or smartphones. This digital divide can exclude certain populations, particularly the elderly or those in rural areas, from utilizing digital banking services. Banks must find ways to ensure that all customers can access essential banking services, whether through physical branches or alternative solutions.

2. Cybersecurity Threats

As digital banking grows, so does the risk of cyberattacks. Hackers continually develop new methods to breach security systems, making it imperative for banks to invest in robust security measures. Customers also need to practice safe online behaviors, such as creating strong passwords and being cautious about sharing personal information.

3. Lack of Personal Interaction

Some customers may prefer the personal touch that comes with traditional banking. For those who value face-to-face interactions, the digital banking experience can feel impersonal. Banks need to find a balance between providing efficient digital services while also catering to customers who prefer more traditional methods.

4. Technological Reliance

Digital banking relies heavily on technology, which can lead to potential issues during outages or technical glitches. Customers may find themselves unable to access their accounts during critical times, highlighting the need for banks to have reliable systems and backup solutions in place.### The Future of Digital BankingLooking ahead, the future of digital banking appears promising. As technology continues to evolve, we can expect to see even more innovative solutions emerge in the banking sector.

Here are a few trends that are shaping the future of digital banking:

1. Artificial Intelligence and Machine Learning

These technologies are set to revolutionize customer service in digital banking. Chatbots and virtual assistants can provide immediate assistance, while machine learning algorithms can analyze user behaviors to offer personalized financial advice. This level of customization can enhance the user experience and build stronger relationships between banks and their customers.

2. Blockchain Technology

Blockchain, the technology behind cryptocurrencies, has the potential to transform banking by increasing transparency and security in transactions. Banks are exploring its applications for various services, such as cross-border payments and smart contracts, which could streamline processes and reduce costs.

3. Open Banking

This concept allows third-party developers to build applications and services around financial institutions, promoting innovation and competition. Open banking can lead to better services for customers, as they gain access to a wider range of financial products tailored to their needs.

4. Sustainability and Ethical Banking

As consumers become more environmentally conscious, banks are focusing on sustainability initiatives. Digital platforms can promote ethical banking by offering transparent information about investments and supporting eco-friendly projects. This trend not only attracts socially responsible customers but also contributes to a more sustainable future.

5. Integration of Financial Services

The future may see a more integrated approach to financial services, where banking is seamlessly intertwined with other aspects of consumers’ lives. For instance, digital wallets may evolve to include budgeting tools, insurance, and investment services, providing an all-in-one financial solution.### ConclusionIn conclusion, digital banking has fundamentally transformed how we interact with financial services. As convenience and accessibility become increasingly important to consumers, the shift toward digital banking will continue to grow.

While it presents unique challenges, the benefits far outweigh the drawbacks, paving the way for a more efficient and user-friendly banking experience.As we look to the future, the industry will need to address issues of security, access, and personalization to meet the evolving demands of consumers. By embracing innovation and prioritizing customer needs, digital banking has the potential to become a cornerstone of our financial landscape, empowering individuals to take control of their financial futures like never before.

Query Resolution: How To Manage Multiple Marketing Channels With Ease

What are the benefits of multi-channel marketing?

Multi-channel marketing enhances customer reach, improves engagement, and allows for better targeting of diverse audiences.

How can I track the performance of different channels?

Utilize analytics tools that offer insights into each channel’s performance, including metrics like engagement rates, conversion rates, and ROI.

What tools can help manage multiple marketing channels?

Consider using marketing automation platforms, social media management tools, and content management systems to streamline your efforts.

How often should I update my marketing strategy?

Regularly review your strategy—ideally quarterly—to adapt to changing market conditions and customer preferences.

Is it necessary to tailor content for each channel?

Yes, tailoring content to fit the specific audience and format of each channel is crucial for maximizing engagement and effectiveness.